About a year ago, 22 people gave each other a promise to help make pension contributions more favourable to Estonian people. These people paid the membership fee and became the founding members of the commercial association Tuleva.

The founding members on their own could not have possibly built up the kind of pension funds we wanted. Funds that would be managed by a management company owned by the pension savers themselves. Funds that would serve the interests of the people, rather than the interests of banks. Such funds were made possible by the 3,000+ people, who became members of Tuleva, when better pension funds were still just a dream.

Today, the dream became a reality. Tuleva’s second-pillar pension funds were put into operation in March. Estonia’s first and only low-cost pension funds created on the people’s own initiative.

The second-pillar pension fund is mandatory for all those working in Estonia (1). Take a moment to check where your second-pillar contributions are currently transferred. Compare the management fee for your old fund with those of Tuleva funds and choose the fund that suits you best.

IF YOU CAN JUST SPARE A MINUTE

I would tell you:

Tuleva’s pension funds are the most favourable in Estonia: the total expense ratio is a maximum of 0.5%, comprising a management fee of 0.34%. This ratio is three times lower than the average for the pension funds of banks.

Tuleva’s pension funds are subject to the supervision of the Financial Supervision Authority, with the rights and guarantees of Tuleva’s customers being equivalent to those of the pension fund customers of banks.

Tuleva’s World Stocks Pension Fund has been designed for a majority of pension savers. Transfer your second pillar to Tuleva’s World Stocks Pension Fund, if you wish to generate the best yield over the long-term horizon and are able to endure short-term market fluctuations.

Tuleva’s World Bonds Pension Fund is a highly conservative fund and is well suited to those who only have a few years to pension age or who are unable to endure short-term fluctuations and are willing to sacrifice a higher yield in order to avoid a potential loss.

Tuleva’s funds have a low cost base and invest, on a well-regulated basis, in the stocks of the world’s leading companies and sovereign bonds. We are not trying to outsmart the market. We are simply dispersing the risks over time and space. When the markets rise, the value of your investment portfolio will grow. At the same time, the new fund units received against the monthly contribution will cost more. In turn, when the markets fall, new units will be available at a lower price.

This is referred to as a passive investment strategy. The world’s economists deem this to be the most reasonable solution for any pension saver. Why? Eight or nine times out of ten, a passive investment strategy has given investors a better long-term yield than active fund management (2).

You will gain the most at Tuleva if you transfer all units of your pension fund(s) and also redirect your future contributions. No-one can predict which fund will provide the best yield over your lifetime. Nonetheless, you can be sure that you will save on commission fees to the maximum possible extent. In turn, these savings will generate a return in the long term. I have already transferred all of my pension assets to Tuleva’s World Equities Pension Fund. As far as I know, the Tuleva team and its founding members are doing the same.

Transferring your pension to Tuleva will only take a few minutes – kindly read the instructions:

CLOSEUP: A LOOK INSIDE TULEVA’S FUNDS

Tuleva’s World Stocks Pension Fund

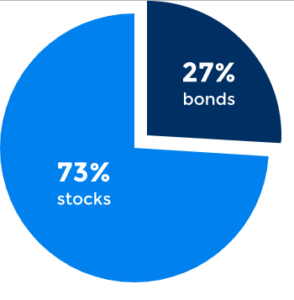

73% of the fund assets are invested in stocks and 27% in securities. Why not 75% in stocks? By law, 75% is the hard limit, which must never be exceeded. Stock prices fluctuate, and 2% is the buffer required for never exceeding the limit established by law. As soon as the proportion of stocks exceeds 74%, the fund manager will sell units of the equities fund to bring the proportion back to 73%.

Two-thirds of the fund assets are divided between three funds governed by the developed-world stock market index. Why three essentially similar funds? The law allows pension funds to invest a maximum of 30% of the fund assets in a single index fund.

Therefore, we invest:

8% iShares Developed World ex-Tobacco Index Fund

28% iShares Developed World Index Fund

28% iShares World Equity Index Fund

You can click on the links to read more on these funds and to check their performance.

One of the funds is “ex-tobacco”. This means that the fund will not invest in the stocks of tobacco producers and firearm manufacturers. This fund has been included within our selection, because the selection of available low-cost index funds did not include any funds investing in the developed-world index, which would have met our all of our requirements. (For example, we established a requirement according to which the purchase and holding of fund units must not incur excessive costs, would be denominated in euros, etc.). It is quite interesting to test whether an investment made with a clear conscience can compromise the yield. Over the last two years, the ex-tobacco fund has fallen slightly short of the performance of other funds in terms of yield. Does this slight difference represent the price of a clear conscience or the cost of a lower risk?

The rest of the fund’s stock investments have been invested in the index fund governed by the developing-world stock markets:

9% BlackRock Emerging Markets Index Sub-Fund

Why is this a separate investment? For some reason, the management fee for a world index fund is higher than the sum of its components. The greatest difference lies in the funds of large markets (developed worlds) and small markets (mainly developing world).

The bond portion of the fund has been invested in the BlackRock Global Government Bond Index Fund`i. Our model portfolio foresees that the fund will invest a part of its bonds in the funds governed by the world bond market index – Bloomberg Barclays Global Aggregate. Government bonds make up 55% of the index.

We are still searching for a fund governed by the entire global debt market index, which would meet all of our requirements. Fortunately, government bonds serve as a sufficiently good standard for the global securities market, with their results shadowing the yield of the entire global securities market. Indeed, things could not possibly be any different, since it is the government bonds that largely determine how the rest of the bond market will behave. With Tuleva’s funds continuing to grow, new possibilities are bound to open up for the purchase of more broad-based bond funds. The government bond fund is performing sufficiently well today.

With regard to bonds, importance must be laid on the fact that, even though the selected fund has been denominated in euros, nearly a third of the fund consists of US government bonds denominated in dollars, a third of euro area government bonds denominated in euros and a quarter of Japanese government bonds denominated in yen. Thus, should the euro strengthen against the yen and the dollar, the value of the fund units will decrease. And vice versa.

In principle, Tuleva could also make use of funds which cover the currency risk. We will not be doing so, since currency exchange rates fluctuations are not the enemy of our pension savers. Historically, the average long-term saver has not gained or lost anything from hedging the currency risk. We would consider hedging the currency risk if this were free of charge. Unfortunately, nothing comes free and any risk hedge will incur costs on the investor. Similarly to other costs – if it does not create value for the pension saver, we will not do it.

Tuleva’s World Bonds Pension Fund

Tuleva’s second pension fund is conservative and does not invest in stocks. The law requires that each pension fund manager must also offer a fund which would allow all those who wish to maximise the yield and are unable to endure any fluctuations in the pension fund units to save for their pension. This fund is a good choice for all those who are nearing pension age and are planning to withdraw the money at the earliest available opportunity (including to transform it into a monthly pension).

Many people are also concerned about fluctuations in the value of their investments. Should you be one of these people, just remind yourself that by saving for the pension in small amounts, your purchases will be well dispersed and you will not have to worry about short-term fluctuations. Jack Bogle, founder of the Vanguard index fund, suggests: “don’t peek”, i.e. do not continually monitor your pension account balance. However, if you cannot help yourself, the bond fund could be a good choice, as there is no greater enemy for the investor than the investor himself, panicking during a downturn.

Tuleva’s World Bond Fund invests a half of its assets in global bond indexes (Bloomberg Barclays Global Aggregate) and the other half in bond indexes denominated in euros (Bloomberg Barclays Euro Aggregate Bond). Why?

On the one hand, the risk will be lower if we disperse the assets between bonds denominated in different currencies. This is what the global index does. On the other hand, short-term currency fluctuations affect the price in euros of funds governed by the global bond market index. In order to hedge the currency risk, assets should be invested in the bond index fund denominated in euros.

This is where we use the simplest risk hedging strategy available: if you cannot ascertain the better of the two strategies, just choose half-and-half.

Tuleva’s bond fund is likely to start out as a very small fund. This will affect the costs. We will therefore start out with a very simple portfolio, consisting only of four funds, each holding a quarter of our fund assets.

We use two funds for following the bond index denominated in euros:

25% BGIF Euro Aggregate Bond Index Fund

25% BlackRock Euro Government Bond Index Fund

Our fund is thus a bit more conservative than the general index, with the share of government bonds being higher.

We use the following funds for following the world bond market index:

25% BlackRock Global Government Bond Index Fund

25% BlackRock Euro Credit Bond Index Fund

The second fund invests in world corporate bonds denominated in euros, and thus tilts towards the euro area. Our fund is growing, providing new opportunities to better mimic the world market without excessively large costs.

TULEVA’S PENSION FUNDS ARE THE MOST FAVOURABLE IN ESTONIA

The total expense ratio of our funds is an annual 0.5%. Why does this number differ from the fund management fee (0.34% in Tuleva’s pension funds)?

When buying a car, one must always consider how much it will cost to maintain. Similarly, when choosing a fund, one must pay attention, in addition to the purchase price, to all other costs that will be borne by the investor.

The pension funds re-invest assets into other funds, which will, in turn, charge a management fee. Brokerage fees must be paid for any transaction with fund assets. These costs on the pension funds managed by banks can be as high as the management fee.

The total expense ratio shows how much the yield of our pension funds is lower than the yield of the indices we follow (after taxes). The lower the total expense ratio, the higher the yield earned by the pension fund investors.

In other words, the lower the cost, the greater the pension.

The total expense ratio of our equity fund is 30-40% lower than that of the index funds currently available on the market (3). I am quite convinced that the costs of our equity fund are at least three times lower than those of Swedbank K4, LHV XL, SEB Energetic and Nordea A Plus. (I kindly ask the managers of all of these funds to correct me, if I am wrong. Unfortunately, the old pension funds have yet to disclose all costs to investors – the law will force them to do so, starting from next year).

For members of Tuleva, Tuleva’s pension funds will be even more favourable. Members can expect to receive an annual pension bonus of 0.05% of their pension assets. Thus, the total expense ratio of these funds is below 0.45% (0.5 – 0.05).

Our bond market is likely to have an expense ratio similar to the second most favourable fund on the market – Swedbank K1. (This is an estimation, since Swedbank has yet to disclose the expense ratio of the funds). We are 30-50% more favourable than other bonds funds.

The expense ratio plays an especially important role in bond funds, with their yield being quite limited. The average annual yield of bonds in a standard Estonian conservative pension fund portfolio is 1.5% after taxes. If the expense ratio of the fund is 1%, the entire yield will be paid to the bank.

I have already transferred all of my second-pillar pension assets to Tuleva’s World Stocks Pension Fund. I will exchange all of my pension fund units against the units of the Tuleva fund and will re-direct all future contributions to Tuleva. Kristi Saare, Community Manager of Tuleva and head of a women’s investment club, has done the same. As far as I know, Tuleva’s founding members are doing the same, except for those three who have yet to establish a pension fund.

I wish you all success in saving up for your pension!

Tõnu Pekk, founder and fund manager of Tuleva

[email protected]

53 044 744

(1) If you were born before 1983, you were given a choice until October 2010 of whether or not to save in the second pillar.

(2) According to S&P data 91% of the US equity funds have fallen short of the index in the last five years. See also a more detailed report on funds denominated in euros.

(3) According to my calculations, the expense ratios for LHV/Swedbank/SEB index funds is 0.77%/ 0.81%/ 0.73%, accordingly. SEB has confirmed that my estimation is an accurate reflection of reality. Other banks have yet to confirm the figures.

Please click here to view the fund conditions and consult our expert.